Nicolas Rubio Interview: Exports of Corn from Brazil To China are Not a Threat to the US

By Isadora Duarte

São Paulo, July 26, 2022 – The director of the Agricultural Trade Office of the United States Department of Agriculture (USDA) in Brazil, Nicolas Rubio, sees no threat to US corn exports to China with the opening of the market in the Asian country to Brazilian corn. In an exclusive interview with Broadcast Agro, Rubio says that there is growing Chinese demand for grains from both countries. “It’s an opportunity that both the United States and Brazil can take advantage of. This is not a concern for the United States,” he said at the backstage Global Agribusiness Forum 2022, an event held by Brazilian agribusiness entities in São Paulo.

Rubio also analyzes that both countries are ready to meet the demands of higher soy quality demanded by China – the main customer of Americans and Brazilians. He also believes that Brazil and the United States have the opportunity to expand grain exports during the war between Russia and Ukraine.

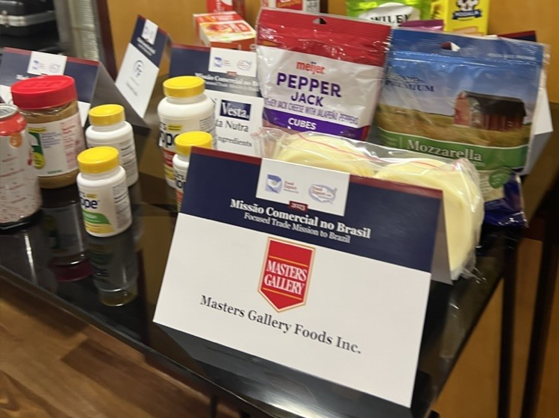

Despite being two major global players in grains and competitors in this market, Rubio sees room for expansion of the American-Brazilian agricultural trade balance. Among the potential products, he cites from bean flour to premium meats and wine. “While Brazil exports US$ 4 billion a year to the United States, we export only US$ 1 billion to Brazil. We see a lot of potential in the Brazilian market for exports of American products”, he points out. As consul for US Agricultural Affairs in the country, he has the promotion of American products as one of his missions in Brazil. He says he will meet this week with representatives of the Ministry of Agriculture to discuss some of these opportunities. Below are excerpts from the interview:

Broadcast Agro – One of the main topics of the [Global Agribusiness] Forum is food security. In this scenario, we have a tightening in the global supply of grains and the restriction of Ukrainian exports due to the conflict with Russia. In your opinion, would the recently agreed resumption of Ukrainian exports immediately alleviate the tightening of the global grain balance?

Nicolas Rubio – There is an immediate impact of the agreement on the relief of supply on the global market because Ukraine has grain to be exported (the Ukrainian government estimates 20 million tons), which unfortunately, because of the conflict, it is unable to export. If the agreement works out as promised, this crop will be exported, as will the new crop, when the producers plant it. In the short term, the agreement is important for the grains to be drained from Ukrainian warehouses and go to the market. The world needs this crop. Corn and wheat are the main products exported by Ukraine.

Broadcast Agro – Do Brazil and the United States have more opportunities in the grain market due to lower exports from Russia and Ukraine because of the possibility of expanding exports to captive markets of these Black Sea countries or more risks due to market volatility?

Rubio – It is an opportunity for producers from both countries [United States and Brazil] to react to this situation and produce more. American and Brazilian producers have the technology to produce a good crop in terms of productivity, without ignoring that there are factors beyond the farmer’s control. If they have a good harvest, both countries are in a position to meet market demand. The Brazilian producer is making his planting decision for the 2022/23 harvest. The crop in the United States, for now, promises to be good, although there is still time for it to develop. But, of course, the conflict in the Black Sea region has an impact on the market because a significant portion of the production is not on the market. The invasion of Ukraine by Russia has impacts, above all, on countries that depend on the region’s production.

Broadcast Agro – Do both Brazil and the United States have the capacity to meet the demand of these countries that at the moment cannot be fully supplied by Russia and Ukraine?

Rubio – We have the capacity, but we need the 2022/23 crop. In the medium term, counting on the harvest of the next agricultural year [2022/23], producers will be able to meet [the demand] and the shortage of these grains tends to be alleviated. There are also other countries that produce and send grain to the region that depends on supplies from the Black Sea, such as Australia, Argentina and Paraguay. All producing countries will have to react to these market conditions.

Broadcast Agro – Now, speaking of the competitiveness between the United States and Brazil, the biggest customer of both in soy, China, is demanding a higher level of protein and oil in the grain. Could these higher quality requirements affect Brazilian and US exports to the Chinese market? Are the two countries prepared to meet this demand?

Rubio – For sure. Today, Brazil and the United States use the best seed technology and have invested in the soybean chain. Without a doubt, I think the United States and Brazil will be able to meet these new demands of the Chinese market. The soy produced today already meets these requirements. In the case of the United States, we are the largest exporter of soy and we have been able to increase the quality and level of protein in the crushing of soy that is exported to China. Undoubtedly, the United States will be able, with technology adopted by the industry, to meet this demand.

Broadcast Agro – In the case of corn, the United States is a traditional supplier to China, while Brazil seeks to open up the Chinese market. Is the entry of Brazilian corn into the Chinese market a threat to US corn?

Rubio – The Chinese market is demanding more grains because it is growing, with greater demand for animal feed and its own corn ethanol program. The United States and Brazil already export good volumes to China. We know that the Chinese market demands products from both countries. It is an opportunity that both the United States and Brazil can take advantage of. This is not a concern for the United States.

Broadcast Agro – In corn, a difference in the production chain of the two countries is the use of the cereal for ethanol. In the United States, about a third of the crop is used to produce biofuel, while in Brazil it is about 10%. Do you see potential in Brazil for expanding the corn ethanol industry?

Rubio – There is already significant growth in corn ethanol in Brazil’s fuel matrix, with just over 10% of corn ethanol in the ethanol blend. There are also many investments taking place by the industry, as in Mato Grosso, for example. We also believe that programs such as Renovabio will encourage an increase in the supply of corn ethanol in Brazil. Our perspective is that corn ethanol production will continue to grow, but sugarcane-based ethanol will still be very important in Brazil. The United States, as an exporter of corn ethanol, also supplies corn ethanol to Brazil when needed.

Broadcast Agro – In the agricultural trade relationship between the United States and Brazil there are still pending issues in some markets, such as meat and sugar. In which markets do you see the possibility of opening up or of greater exchange between the two countries?

Rubio – The Brazilian-American bilateral market has many opportunities. Brazil already exports more than US$ 4 billion worth of products to the United States. The American market is very important for Brazil. Last year, the United States exported only US$ 1 billion worth of products to Brazil. We see a lot of potential in the Brazilian market for the acquisition of American products. Meat is one of those products. In 2017, we had a bilateral agreement in this regard and we see an opportunity for American premium cuts in the Brazilian market. Our Consulate works, together with American exporters, to open these opportunities and to increase exports of our products to Brazil. We see opportunities for new products, in addition to expanding the volumes of those we already export.

Broadcast Agro – In addition to premium meats, for which other products does the United States see room to export to Brazil?

Rubio – We work hard to expand the ingredients that can be processed by the Brazilian food industry. One of these products for which we see an opportunity is bean flour, developed in the United States to increase protein in plant-based foods. We also look at opportunities in exporting American wines to Brazil, whose consumer market is growing. Another product that we export and for which we see room for expansion in Brazil is milk protein, which can add value to Brazilian food products. We also believe that we can increase the export of pears, cherries and wild salmon.

Broadcast Agro – On the other hand, for which products is there potential for Brazil to increase exports to the United States, or open up [its market]?

Rubio – Brazil is very interested in exporting fruits from the Northeast to the United States. It is an old dialogue in an attempt to open up opportunities for Brazilian fruits in the American market.

Broadcast Agro – Are there ongoing negotiations with the Brazilian government to open these markets that are of interest to the United States?

Rubio – Brazil has been a trading partner for many years. We always have conversations with areas of the Brazilian government, specifically with the Ministry of Agriculture, which is a partner in the commercial, data collection, biotechnology and climate change areas. This week we will have a meeting with the Ministry to address issues that are important to both countries.

Contact Isadora Duarte through the email isadora.duarte@estadao.com. Click here to check the news in the Broadcast Agro portal.